The cryptocurrency market is experiencing a resurgence, with a bull run that has seen prices soar and investor enthusiasm reach new heights. This blog post will delve into the factors driving this bull run, analyze its potential impact on the broader financial landscape, and provide insights for investors considering entering the crypto market.

Understanding the Bull Run

A bull run in the crypto market is characterized by a sustained period of upward price momentum, often accompanied by increased trading volume and investor interest. The current bull run, which began in early 2024, has been fueled by several key factors:

- Institutional Adoption: Major financial institutions and corporations are increasingly recognizing the potential of cryptocurrencies. This increased institutional involvement has brought greater credibility and stability to the market.

Companies like PayPal and Visa are expanding their crypto payment solutions.

Institutional investors, such as BlackRock, are exploring Bitcoin Exchange-Traded Funds (ETFs), signaling mainstream acceptance. - Regulatory Clarity: Governments around the world are taking steps to establish clear regulatory frameworks for cryptocurrencies. This regulatory clarity has reduced uncertainty and encouraged greater participation from traditional investors. The most recent election of Donald Trump as the new president of United States of America has also brought a huge wage of trust in people and has increased interest of general public.

- Technological Advancements: The underlying blockchain technology continues to evolve, with new innovations and applications emerging. These advancements are expanding the potential use cases for cryptocurrencies and driving market growth.

Ethereum’s Upgrades: The shift to Ethereum 2.0, incorporating energy-efficient proof-of-stake mechanisms, has reignited interest in the platform and DeFi projects.

Layer 2 Solutions: Advancements in Layer 2 scaling solutions, such as Polygon and Arbitrum, are making blockchain technology more accessible and cost-effective.

Growth in NFTs and Web3: The resurgence of NFTs and their integration into gaming, art, and the metaverse is bringing new participants into the crypto ecosystem. - Market Sentiment: Positive market sentiment, fueled by news of technological breakthroughs, successful projects, and increasing mainstream adoption, has played a significant role in driving the bull run.

- Macroeconomic Factors: The current macroeconomic environment, including low-interest rates and inflationary pressures, has made cryptocurrencies an attractive investment option for some investors seeking diversification and potential higher returns.

Weakening US Dollar: Inflationary pressures and monetary policy uncertainties have reduced the purchasing power of fiat currencies, prompting investors to seek alternative stores of value like Bitcoin.

Low Interest Rates: While central banks are adjusting monetary policies, many investors are turning to cryptocurrencies to hedge against traditional market risks.

Geopolitical Tensions: Conflicts and economic uncertainties have driven demand for decentralized assets, particularly Bitcoin, as a “digital gold” safe haven.

Potential Impact on the Financial Landscape

The ongoing bull run has the potential to reshape the financial landscape in several ways:

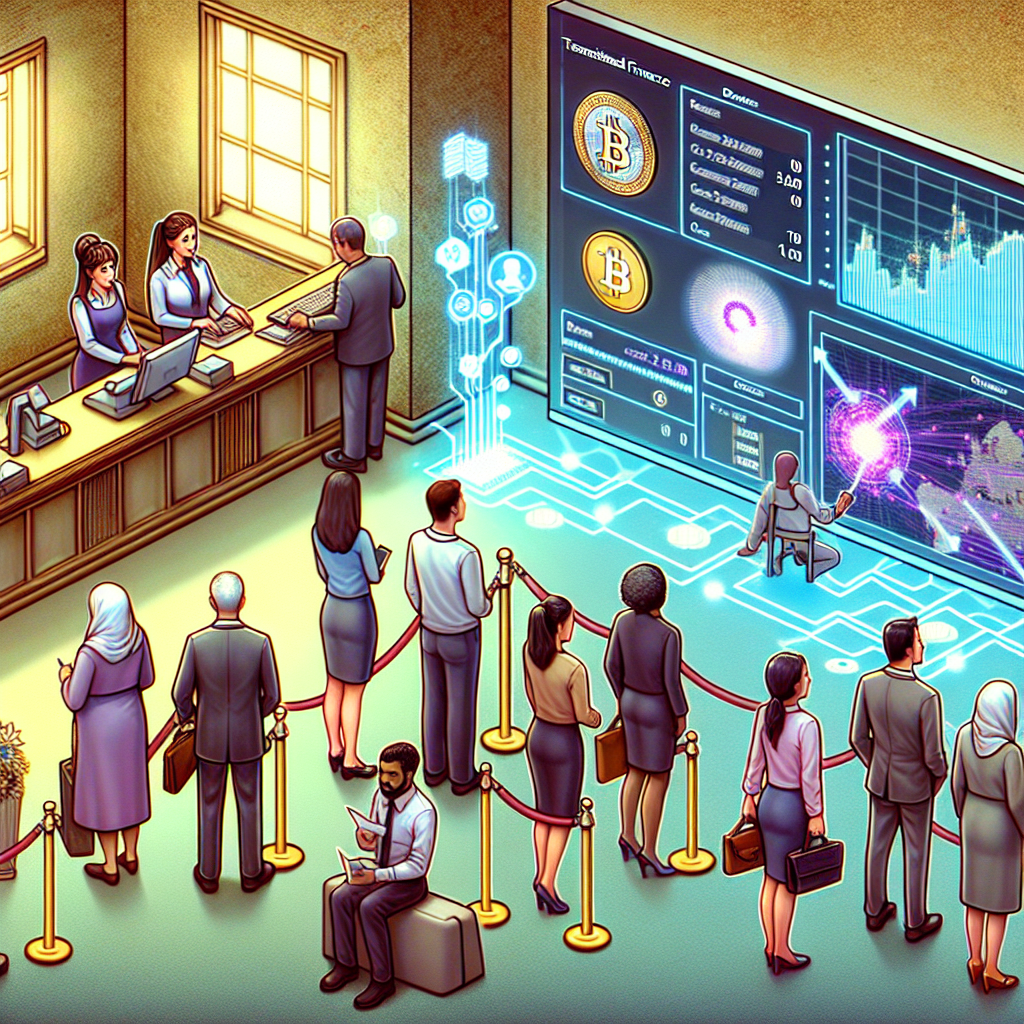

- Increased Financial Inclusion: Cryptocurrencies can provide financial access to millions of people who are currently underserved by traditional banking systems.

- Disruption of Traditional Finance: Decentralized finance (DeFi) protocols are challenging traditional financial intermediaries, offering innovative solutions with lower costs and greater transparency.

- Global Economic Impact: The widespread adoption of cryptocurrencies could have significant implications for global trade and economic development.

Market Trends During the Bull Run

1. Bitcoin as a Market Leader

Bitcoin remains the bellwether of the crypto market, with its dominance index rising during this bull run. Its role as a digital store of value attracts both seasoned and new investors.

2. Altcoin Surge

While Bitcoin leads, altcoins like Ethereum, Solana, and Cardano have also experienced significant gains, driven by their technological use cases in decentralized finance (DeFi), gaming, and enterprise solutions.

3. Increased Trading Volumes

Crypto exchanges have reported a surge in trading volumes, indicating heightened interest from both retail and institutional participants. Futures and options markets have also seen higher activity, reflecting sophisticated strategies by traders.

4. Broader Adoption

Countries like El Salvador and jurisdictions such as Hong Kong are adopting pro-crypto policies, which bolster global confidence in digital assets.

Investing in the Crypto Market

For investors considering entering the crypto market, it is crucial to conduct thorough research and understand the risks involved. Here are some key considerations:

- Diversification: Spread your investments across various cryptocurrencies to mitigate risk.

- Risk Tolerance: Assess your risk tolerance and invest accordingly.

- Long-Term Perspective: Cryptocurrencies are a long-term investment, and short-term price fluctuations should not dictate your investment strategy.

- Security: Prioritize the security of your crypto assets by using reputable exchanges and secure wallets.

- Stay Informed: Keep up-to-date with the latest news and developments in the crypto market.

Conclusion

The current bull run in the crypto market is a testament to the growing maturity and mainstream acceptance of cryptocurrencies. While the market is inherently volatile, the underlying fundamentals and long-term potential remain strong. By carefully considering the factors driving the bull run and managing risk effectively, investors can position themselves to capitalize on the opportunities presented by this dynamic and evolving market.